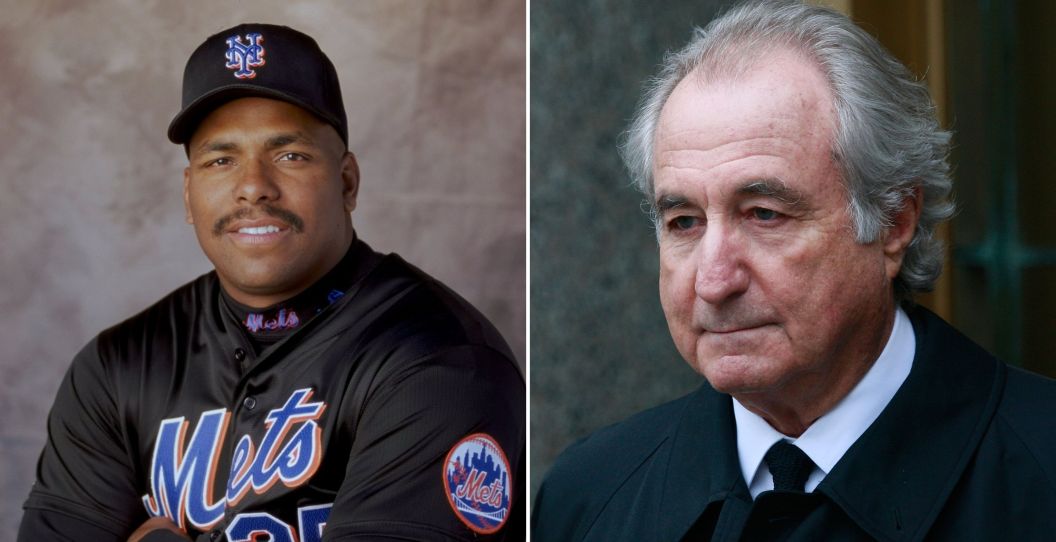

Every year, on the first of July, baseball fans everywhere celebrate Bobby Bonilla Day, much to the chagrin of Mets fans.

ESPN has never missed a moment to harp on what is considered the worst contract in Major League Baseball History. But, why do so many celebrate Bobby Bonilla Day? Because it means the New York Mets are paying former Mets outfielder Bonilla $1,193,248.20 today, like they have every July 1 since 2011, and will until their final payment on July 1, 2035. Talk about a fantastic payday.

But why are they doing this? Why did the Mets make such a horrible financial decision that has lasted for decades? Buckle up. This one's a wild ride.

When the Mets Spent Money They Didn't Have

RELATED: "Bobby Bonilla Day" is a Million-Dollar Treasure

In 2000, the Mets ownership group agreed to buy out the remaining $5.9 million of Bonilla's contract. But, they hedged their bets. At the time of the Bonilla deal, the Mets were invested in a Bernie Madoff account that was meant to yield significant double-digit returns.

With that in mind, the New York Mets owners and general manager signed off on something interesting. Instead of paying that out the rest of Bonilla's Mets contract up front, they agreed to pay out just under $1.2 million for 25 years, including an 8 percent interest rate. This, obviously, is not a normal way to handle a contract buyout or a long-term contract, but then again, this was Bonilla's second go with the Mets, after having signed a five-year deal back in 1991 to play in Queens.

That said, leaning into trusting a real estate mogul is...a choice. Any Mets fan will tell you that they were glad Fred Wilpon, Jeff Wilpon and company sold to Steve Cohen. It has helped to reinvigorate the team's product on the field, but it also was the end of a really weird era for the Mets.

Citi Field should be a place in which high-value free agents long to smash home runs or vie for a perfect game. It shouldn't be a place in which a hedge fund manager who was ultimately jailed for an elaborate Ponzi Scheme is looming overhead. And yet, that baseball team from Queens was one among many of Bernard Madoff's victims.

Madoff and the Mets: An Unlimited Bankroll

The Madoff scandal truly came to light in 2008, seven years after Bonilla took his final at-bat as a member of the St. Louis Cardinals in 2001. But the Wall Street executive had alarms sounding against him for some time before authorities took him into custody.

From the time of issues first raised in 1999 (and likely well before) to his conviction in 2009, Madoff's Ponzi Scheme made a fool of many. At his highest, Madoff was Chairman of NASDAQ. At his lowest, he was charged with securities fraud, investment advisor trust fraud, mail fraud, wire fraud, money laundering, false statements, perjury, making false filings with the SEC, and theft from an employee benefit plan.

Let's rewind. What exactly was this fraudulent scheme, and how did it come to envelop New York City's National League team in its wrongdoing?

Investigators believe Madoff's malpractice began as early as the 1970s. He had gotten his firm off the ground in the '60s, and by the early '90s he was being lauded for his success by the likes of the Wall Street Journal. Essentially, he created a practice that lured investors in by promising extraordinarily high returns. This is quite literally the definition of a Ponzi Scheme.

Why is it called a Ponzi Scheme? Because a man named Charles Ponzi was a con artist who promised investors 50 percent returns that he was not able to fulfill. When found out, he ended up serving a 14-year sentence. And that was in 1920.

Essentially what was happening was Madoff was promising high returns and collecting investments. He then would lure in new investors and pay them with the investment from the previous ones. So instead of that money yielding legitimate returns, it was continuously being passed down the line.

Fast forward 70 years and you'd think that the world had found ways to identify such fraud. And yet, an MLB team found itself wrapped up in all of it because they, like many, trusted the source.

According to the Associated Press, many investors trusted Madoff because he was Jewish. They truly leaned into the stereotype, thus allowing him to dig deeper and his bank accounts to grow larger.

Ultimately, Madoff wasn't going to be able to pay it off when investors came calling, and that became his undoing when the market went south in 2008. As his victims tried to make their investments liquid, the river had run dry.

Bobby Bonilla's Annuity Funded by Madoff's Scheme

So it's interesting that, at a time in which the Mets were to compete with the Yankees in a Subway Series World Series, they made the choice to not pay out the six-time all-star in the way their outfielder/first baseman/third baseman needed. They were able to top the Marlins, Phillies and Expos in the division, but the Braves finished above them by one game. So they were a Wildcard team that found their way through the playoffs, winning the pennant and competing for the ultimate prize.

And yet, they trusted in Madoff. So instead of paying $5.9 million at the time, they spread it out, in hopes that would all come out in the wash and the annuity would take the burden off the team's payroll. Instead, they ended up committing to nearly $24 million more than they had originally anticipated. By the time they make their last payment to Bonilla, he will be 72 years old.

That's just one example of the effects Madoff had on his investors. In the long run, the New York Mets are a franchise that has been able to find its way. And, really, it's pennies to them in comparison to what it could be for others. It became the job of Massachusetts native Attorney Irving Picard to dive into things and help recover the billions of dollars that were lost in Madoff's scheme.

A Financial Mess of the Mets

New York City sort of defines the concept of the American Dream. The Bronx and Queens hold long-term ties to baseball, as did Brooklyn before the Dodgers found their way to Los Angeles. And Manhattan has always been the center of attention. Wall Street represents this ability to earn and grow beyond anything you could imagine. The New York Times tells you everything you need to know.

When you look at who can get caught up in a scheme like Madoff's, you expect a lot of the "little people" to fall victim. You wouldn't expect a major league franchise worth nearly half a billion dollars to be caught with their pants down, too. And yet, that's just what happened to the Mets.

I'm sure Sandy Alderson and Billy Eppler would rather just be funneling salary to his sluggers or his prized shortstop, Francisco Lindor. But instead, thanks to Bernie Madoff, a small chunk of that money is still finding its way into Bobby Bonilla's pocket. So what does he do? He leans into it. There's a difference between owning the New York Mets and the Boston Red Sox vs. owning the Chicago White Sox and the Baltimore Orioles. That difference is that you need to go out and get Barry Bonds, Max Scherzer or Pedro Martinez, and make a stand. Bonilla's teammates may begin making the trek to Citi Field to celebrate the regional holiday. The Mets are leaning into it.

Here we are over a decade from that first deferred payment and over two decades from when the deal was made. From now until 2035 we can always check the calendar, see its July 1, and wish everyone in Queens a happy Bobby Bonilla Day, as we all tune into the Mets game to watch them get absolutely dunked on.

This article was originally published on July 1, 2022, and will be updated until 2035, when Bobby Bonilla's contract is finally paid off.