The National Football League has fooled oddsmakers across the nation. This season, NFL games are landing under the total number of projected points 59.3% of the time.

Generally, oddsmakers are looking to set the line on the total number of points to be as accurate as possible. It is in the best interest of the sportsbooks, as they would like to optimize the total, landing over and under close to 50% of the time. This way, the sportsbooks can draw two-sided action and make money. If lines become too predictable, they would lose money.

It is reasonable, however, to understand that there may be slight leans either way, even in the long term. In fact, according to The Action Network, the NFL had 52.1% of its games go under the total from 2017-2021. When you extend the data out to 2005, the NFL has had only 50.3% of its games go under the total.

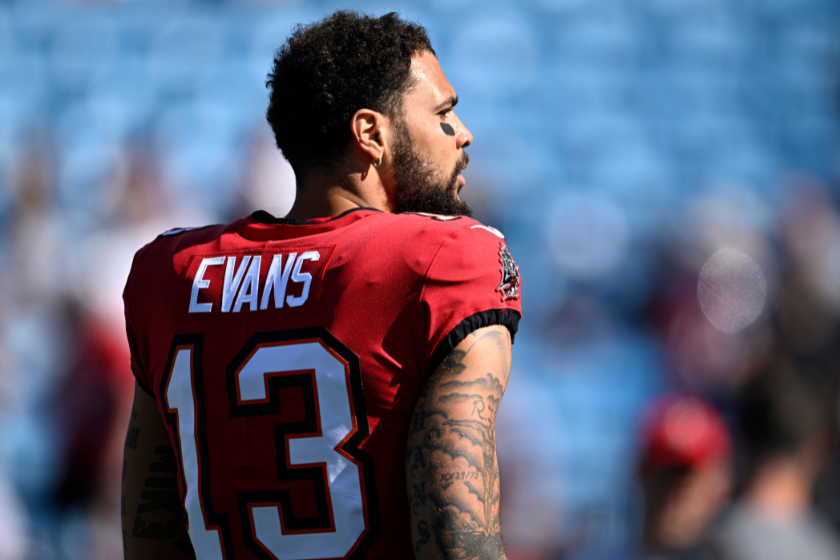

An Underwhelming NFL Season

Photo by Eakin Howard/Getty Images

RELATED: The Value of a Rushing Quarterback: How Lamar Jackson Has Changed Everything

Overall, the lean to the under may have to do with the fact that the betting public tends to play the over, meaning that the line will tend to rise and go higher than it should be slightly more often than not.

Still, 52.1% and 50.3% of the time on either side is not blindly profitable with the traditional juiced odds of -110, showcasing the sportsbooks' ability to set the line correctly. 59.3% is profitable, however, and we are several weeks into the NFL season.

Through the first seven weeks NFL teams are averaging 43.4 points per game, the lowest since the 2010 season. In 2021, teams put up 47.2 points per game through seven weeks of the season. Even the oddsmakers can't figure out why teams are scoring less, but perhaps there are a few factors to consider.

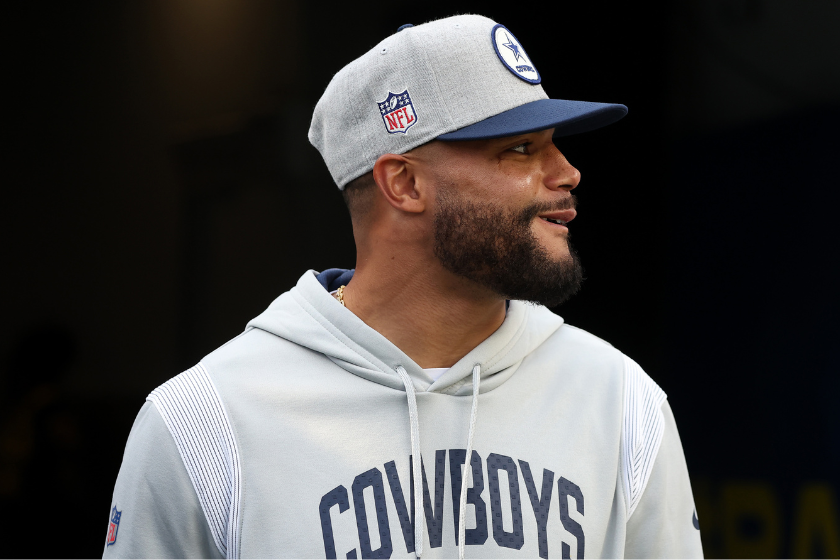

A Preseason Problem

Photo by Sean M. Haffey/Getty Images

Many believe that the drop in scoring may have something to do with a lack of preseason participation from starting players. A lot of teams do not play their best players in exhibition games, saving their efforts and health for the regular season. As players miss snaps and reps they would otherwise have, they also miss opportunities to grow with the offense they will work with the rest of the season, justifying a slow start and lack of rhythm.

The most glaring example of this phenomenon may be Russell Wilson and the Denver Broncos. Wilson did not take a snap in preseason, and his offense has struggled under his leadership. The former Super Bowl champion, and nine-time Pro-Bowl selection, is completing a career low 58.6% of his throws. Wilson also ranks 29th of 32 NFL starters in total quarterback rating and is a part of the lowest scoring team in the league, as the Broncos only score 14.3 points per game.

Wilson is not the only quarterback and offensive piece to sit out during preseason. But there are other factors at play. One of those other factors may have to do with the way NFL teams defend the pass. The NFL has become pass happy as the likes of Patrick Mahomes, Josh Allen, Justin Herbert and Joe Burrow can throw lasers to any point on the field.

To compensate, teams are dropping back coverage more than ever, making life difficult for the passer. NFL Senior Director of Football and Analytics Mike Lopez reported that NFL teams are using more Cover 2 Zones and Cover 4 Zones. The Cover 2 Zone allows a team to drop back two safeties, and a Cover 4 does the same with the addition of two cornerbacks coming back into coverage. These schemes lead to tighter windows downfield and less success in moving the ball or doing so quickly. Passing completion percentage is down to 62.6%, a five-year low, and deep balls of 25 or more yards are only completed 27.7% of the time.

Even if teams can make up for a bad passing attack with a solid run game that moves the chains, it still won't make up for the inability to score as quickly as the passing game. Throwing the ball stops the clock more frequently as receivers get out of bounds. Passing also tends to gain more yardage, meaning teams move the ball towards the end zone and field goal range quicker.

Over Promising Under Center

Photo by Julio Aguilar/Getty Images

Another element of the game may have to do with the league's culture and its development of quarterbacks. Quarterbacks that were high draft picks out of college used to wait around for longer, playing only in certain spots to develop into starters, so they were "ready" when called upon.

Nowadays, teams appear less patient, pushing their talent to start as soon as possible. Looking at the quarterback class from the NFL draft in 2021, almost all were asked to be the Week 1 starter in their first year. Ready or not, Trevor Lawrence, Zach Wilson and Mac Jones were leading their teams right out of the gate.

For Lawrence and Wilson, it was a rough year. Lawrence finished with 12 touchdowns to 17 interceptions while he completed only 59.6% of his throws. Wilson started 13 games, and also had a negative touchdown to interception ratio with a completion percentage of 55.6%. In 2021, the Jaguars finished last in the league in points per game (14.9), and the Jets barely did better (18.2).

Though Jones made the Pro-Bowl, his success certainly had at least something to do with the conservative offensive play calling and the help of an elite coach in Bill Belichick.

Whatever the reason might be, NFL bettors might have to lean to the under the rest of the way in 2022. As long as the oddsmakers fail to adjust the totals for the struggling offenses, there may not be a safer play on the board.