Remember the Alliance of American Football, the league that was supposed to bring us joy but ended up bankrupt in the middle of its first season? Well, it's still dead, but that's not stopping anyone from reopening old wounds. That includes the man who tried to save it in the first place.

Videos by FanBuzz

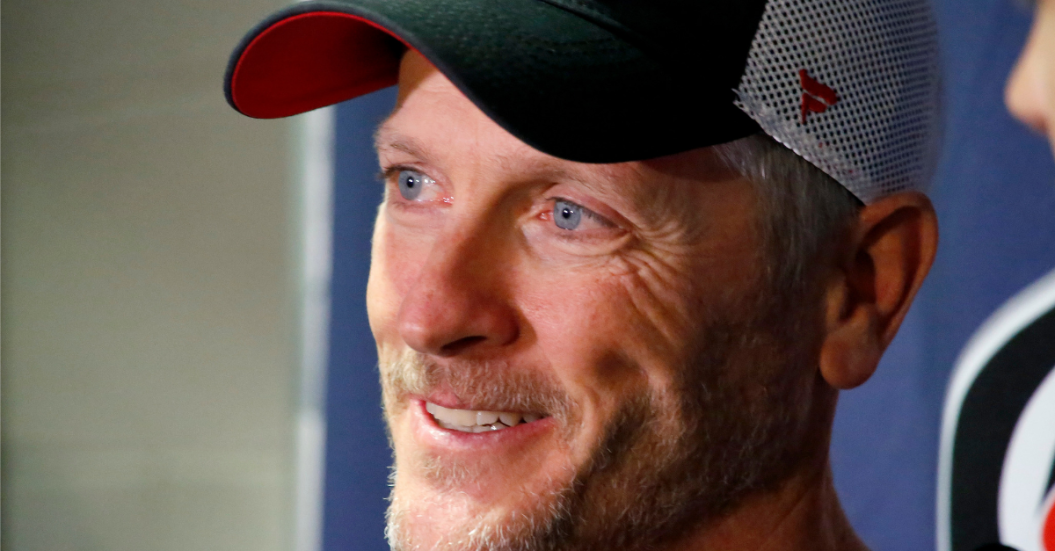

In plainest terms, NHL's Carolina Hurricanes owner Tom Dundon wants a refund of the $70 million he invested to keep the AAF alive and has filed there were "misrepresentations" to get him to do it in bankruptcy court, according to legal documents obtained by The Athletic.

Someone told Dundon that money would get the AAF through its first season, but that obviously wasn't the case. The football league likely needed $120 million to make it out alive.

What started as a supposed lending hand to Alliance CEO and co-founder Charlie Ebersol, as well as Bill Polian, just keeps getting uglier and uglier as the weeks pass.

Tom Dundon makes his move against @TheAAF, alleging that "misrepresentations" compel repayment of the $70M he spent https://t.co/NDcUrlJcUi

— ProFootballTalk (@ProFootballTalk) June 25, 2019

RELATED: The AAF is Dead, But Its $250 Million Investor Stole Exactly What He Came For

This entire situation, if you can even call it that, is bizarre. Tom Dundon saved the league with his pocket book and what kept the AAF alive during its inaugural season was also the very thing that killed it. And now this.

"Even though AAF executives told [Dundon Capital Partners] its contribution would get the AAF through the first season, those executives knew at the time of the execution of the Term Sheet that the AAF would likely need an additional $50,000,000 (including League revenue) on top of [Dundon Capital Partners'] investment of up to $70,000,000 to get through the first season. "The AAF and its executives never disclosed this information to [Dundon Capital Partners]."

In order to be a billionaire, you have to make some smart financial decisions along the way. So you better believe he knew the risk, yet is still crying wolf to get some funds back because it didn't have the same success as the NFL or even the XFL.

"The AAF further represented that it could survive the season with only $55,000,000, leaving substantial capital to prepare for the following season. During the weeks following the execution of the Term Sheet, [Dundon Capital Partners] learned a number of alarming facts that revealed that the AAF was not forthcoming with Dundon and [Dundon Capital Partners]. [Dundon Capital Partners] learned that, in addition to not having the funds to pay salaries after the first week of the League's games, the AAF also had accumulated more than $13,000,000 in unpaid debts and commitments. The AAF did not disclose these unpaid debts or commitments to [Dundon Capital Partners] prior to the execution of the February 14, 2019 Term Sheet."

As if the AAF players from teams like the Birmingham Iron, San Antonio Commanders or Orlando Apollos weren't already upset football operations were suspended, everyone now gets to watch a world of class-action lawsuits unfold.

This is just another chapter in a messy divorce.

And if you need an example of what this looks like, The Berenstain Bears and the Blame Game on Amazon is a good place to start.